Are you overpaying for merchant processing?

By Michael Amen

How closely are you reading your monthly payment processing invoice? If, as a merchant, you’re paying without understanding how processors can hide and inflate fees, you could be significantly overpaying.

“I work in finance and analyze a lot of our clients’ merchant statements from other processors. I see many types of buried fees all with different descriptions,” explained Michael Amen, Associate Vice President, Finance and Accounting for ConnexPay. “Merchant processing statements are like snowflakes– no two are the same.”

What’s your pricing model?

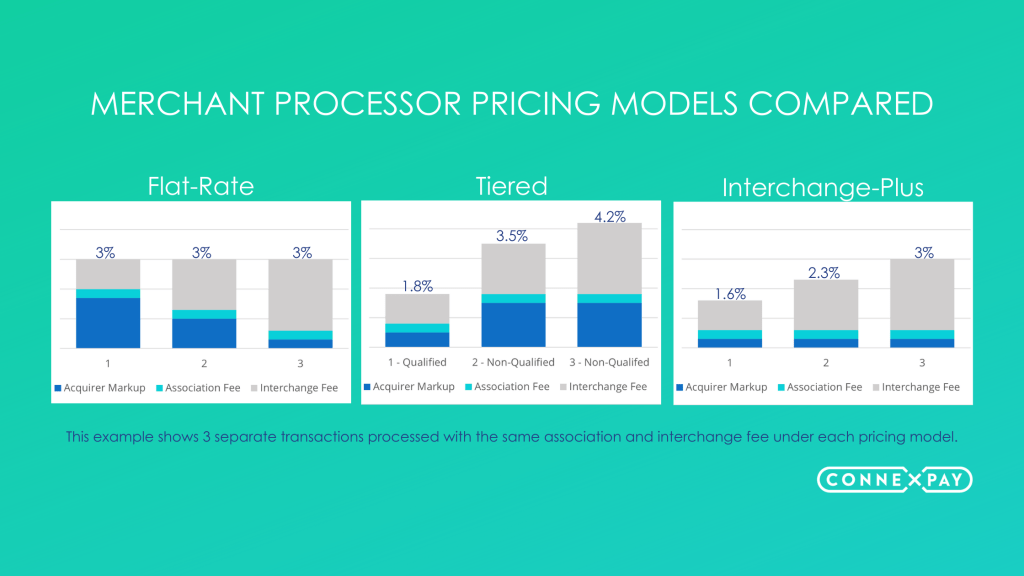

First, it is important to understand that there are three pricing models processors commonly use: flat-rate pricing, tiered pricing, and interchange-plus pricing. Check your statement to find out what type of pricing model you’re set up with to better understand what you are paying your processor and where you may be overpaying.

Flat-rate pricing: Hidden and inflated fees

Processors that utilize flat-rate pricing charge one fixed fee that is consistent for every transaction, no matter the actual interchange cost. This seems attractive from a consistency standpoint; however, merchants rarely come out ahead with this pricing structure.

“While consistency and predictability are benefits for this type of pricing, the downside is that fees can be as high as 3.5% per payment with no clear distinction as to what is going to the card networks vs the processor,” Amen commented. “You have to remember; processors don’t want to lose money to the card networks, so they are always going to inflate their price to exceed every possible interchange fee. If a merchant is paying via flat-rate pricing, it will be inflated in a way that is not visible to the merchant without a deep analysis of the actual base interchange cost.”

Tiered pricing: The low rate that’s nearly impossible to achieve

To entice prospective customers, many processors use a tiered pricing model which allows them to offer and advertise an extremely low rate for “qualified” transactions and a much higher rate for “mid-qualified” and “non-qualified” transactions. What makes a transaction qualified as opposed to mid- or non-qualified? It depends on the processor.

A processor determines what is considered qualified or non-qualified and does so at their discretion. The processor doesn’t have to provide an explanation and can change a transaction’s status to a non-qualified (higher) rate any time they want. If a merchant complains that most of their transactions are being categorized as non-qualified, the processors often blame it on the card brands, which have little to do with determining a qualified transaction over non-qualified.

“Tiered pricing, and determining qualified and non-qualified transactions, is generally the biggest offender of hidden prices.” said Amen. “I’m actually very shocked by how almost shameless this practice really is — you’ll see only 5-10% of volume land into the qualified bucket at the lower rate. The remainder of transactions often land in the non-qualified bucket. For merchants that ConnexPay helps by reviewing their processing costs [from other processors], we typically see about 90% of their volume land in the non-qualified bucket, which, of course, has a much higher surcharge.”

Interchange-plus: Transparency through itemized fees

Interchange fees apply to every credit and debit card transaction. The rate is determined by the card networks, so they are consistent across processors no matter the pricing model. Each card brand sets their interchange rates by card product and transaction type. The interchange fees are collected by the card networks through the merchant processor.

A payment processor does get the opportunity to determine how this fee is passed on to its merchants, either directly through interchange-plus or indirectly through tiered or flat-rate pricing models. Interchange-plus pricing models combine interchange fees with card network assessments and then add a contracted “markup” that is consistent across all payments. The interchange rates in this pricing model will fluctuate depending on the card product, but unlike other models, it is completely transparent and is an exact passthrough of what is being charged by the card networks. For example, when merchants acquire low-cost cards, they will save that money themselves as opposed to other models where the savings are enjoyed by the processors.

“At ConnexPay we use the interchange plus structure. Clients can itemize exactly where every fee is coming from and it’s extremely transparent. I think the most important but often overlooked aspect in merchant processing fee structures is transparency,” said Amen. “With the other two structures, it’s hard to tell what you’re paying a processor for because they all get lumped into one charge. While it’s convenient, from a reconciliation and predictability standpoint, it is extremely difficult to understand what you are actually paying your processor. With interchange-plus pricing, interchange fees, card brand fees, and processor markup are shown clearly and itemized for the merchant.” Amen explained.

Merchants may be hesitant around interchange plus pricing because it is not as predictable as flat rate and tiered. It comes down to deciding if you want predictability in your rate or transparency.

Know your rights

Regardless of which of the three pricing models your processor uses, understanding the fee structure is key in determining how much you’re paying, why you’re paying it, and whether you’re being overcharged. As a merchant, you have the right to approach your processor with your invoice and ask to be walked through each line item. If a processor complies, you can question whatever fee is applied. If your processor refuses, it could be they are shielding a wealth of hidden fees within your invoice.

Michael Amen is the Associate Vice President, Finance and Accounting, for ConnexPay. Amen’s role includes analyzing merchant statements for prospective customers.

ConnexPay guarantees lower merchant processing fees than your current provider.

With transparent interchange-plus pricing, guaranteed lower fees and no processing limits, ConnexPay offers best-in-class for its merchants. Find out if your marketplace business is overpaying by speaking with our payments team today!